Smaller portions, bigger impact: how GLP-1 drugs like Ozempic® are reshaping food manufacturing

Videojet Knowledge Hub Team

Trends, food, Ozempic®, GLP-1

Ozempic®, Wegovy®, and Mounjaro® are changing more than just waistlines; they’re reshaping the food industry. As millions cut their daily calorie intake by 700-1,000, demand for high-calorie products is dropping, while healthier, smaller-portion options are on the rise. This long-term shift is transforming how we eat, shop, and how food companies operate. Let’s explore what’s next.

What happens when millions eat fewer calories?

When millions of consumers start eating 1,000 fewer calories per day, the food industry is starting to feel the impact across factory floors, product labels, and supply chains.

Of course, the food industry is no stranger to disruptions, with the plant-based food revolution, sugar taxes, sustainable packaging demands, and more. But the rise of GLP-1 receptor agonists like Ozempic®, Wegovy®, and Mounjaro® may be its most profound transformation yet.

Originally developed for diabetes and obesity management, these medications are now reshaping how people eat, shop, and think about food. For food manufacturers, this isn’t just a health trend, it’s a structural shift with far-reaching implications.

What are GLP-1 drugs and how do they affect appetite?

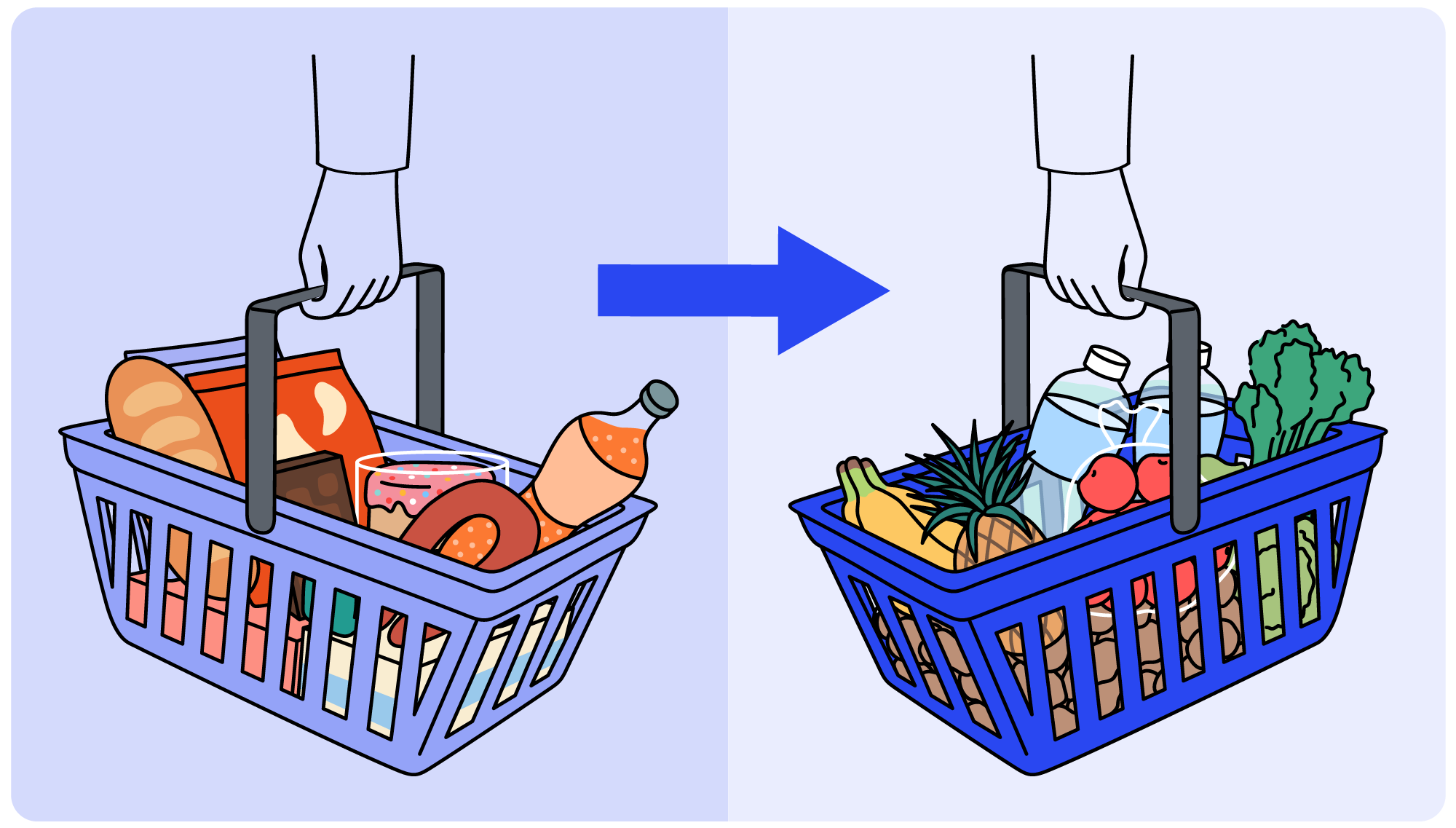

GLP-1 drugs mimic a hormone that regulates appetite and blood sugar, leading users to consume 700–1,000 fewer calories daily and reduce cravings for high-fat, high-sugar foods and processed foods. Retailers like Walmart have already reported declines in snack and sweets purchases.

What does this mean for food producers?

The shifting landscape of consumer preferences is reshaping the food production industry, creating significant implications for manufacturers. Key trends include:

- Declining demand for traditional high-calorie products: Expect reduced volume in categories like snacks, sugary drinks, and processed meals.

- Rising demand for health-forward alternatives: High-protein, low-sugar, and gut-friendly foods are gaining traction.

- Shorter product lifecycles: Rapid shifts in consumer behavior require faster reformulation and innovation cycles.

How can manufacturers meet operational complexities?

As product portfolios diversify to meet new dietary expectations, manufacturers face

- increased complexity with more SKUs to cater to niche needs,

- smaller packaging formats requiring high-resolution coding solutions,

- and faster changeovers to maintain agile production lines.

- Additionally, eco-conscious consumers are pushing for more recyclable packaging and the use of sustainable inks, adding to the pressure on manufacturers.

To keep up, manufacturers need modular, high-speed marking and coding systems that enable quick changeovers and support data-rich labeling, such as QR codes and nutrition panels. Recent advancements in laser marking technology like Videojet SmartFocus™ enable quick changeovers and consistent code quality across diverse packaging formats.

How can brands protect reputation and consumer trust?

Facing counterfeit semaglutide products and rising health scrutiny, food manufacturers are looking to protect their brand image. Consumers demand safety, transparency, accurate labeling, and proof of authenticity, especially as dietary needs diversify.

For food producers, this means:

- A broader, more diverse user base with varying dietary needs.

- Greater pressure to ensure traceability and authenticity in the supply chain.

- Heightened scrutiny around health claims and labeling accuracy.

“Smart packaging technologies like serialized QR codes and digital twins offer a powerful solution. Laser marking enhances this by delivering permanent, tamper-proof 2D codes that resist wear and counterfeiting, reinforcing consumer safety, traceability and brand protection at every stage of the supply chain. In this new landscape, brand protection isn’t just about security, it’s about earning and sustaining consumer trust.”

Do behavioral shifts last beyond prescriptions?

GLP-1 users often report more mindful eating habits, reduced emotional eating, and a preference for smaller, simpler meals. These behaviors tend to persist even after discontinuation of the medication, suggesting a long-term decline in volume-driven consumption.

This shift toward quality over quantity means manufacturers must rethink value propositions. It’s no longer about “more for less” – it’s about “better for you.”

Final thoughts

“The “Ozempic® effect” is not a passing phase, it’s a paradigm shift.”

As GLP-1 drugs become more widespread and macro-tracking, the counting of macronutrients, becomes mainstream, the ripple effects will reshape the entire food supply chain. For manufacturers, the challenge is not just to adapt, but to lead.

By embracing agility, transparency, and consumer-centric innovation, food producers can turn disruption into opportunity. The appetite for change is real. The question is: are you ready to feed it?

Sources

Ozempic Reshapes The Kinds of Food People Eat. Here’s What Happens. : ScienceAlert

Examining the Impact of GLP-1 on the Food Industry | Clarkston Consulting

How Ozempic Is Affecting Food Sales – GLP-1 Drugs Impact

QR Code is a registered trademark of DENSO WAVE INCORPORATED.